About Us

Trustees

Policyholders

Purposeful investments

Sustainability

Investors

New & insight

Slavery and human trafficking remain a hidden blight on our global society. We all have a responsibility to be alert to the risks, however small, in our business and in our wider supply chain.

This statement is made pursuant to section 54(1) of the Modern Slavery Act 2015 and constitutes our Group's slavery and human trafficking statement for the financial year ending 31 December 2024.

Pension Insurance Corporation plc ('PIC') is a specialist insurer that provides tailored pension insurance buy-ins and buyouts to the trustees and sponsors of UK defined benefit pension schemes.

PIC’s purpose is to pay the pensions of its current and future policyholders. PIC is committed to providing secure and stable retirement incomes through financial strength, leading customer service, comprehensive risk management and excellence in asset and liability management.

PIC’s 2024 new business success:

We currently have 636 employees and have an annual turnover of £8,064 million

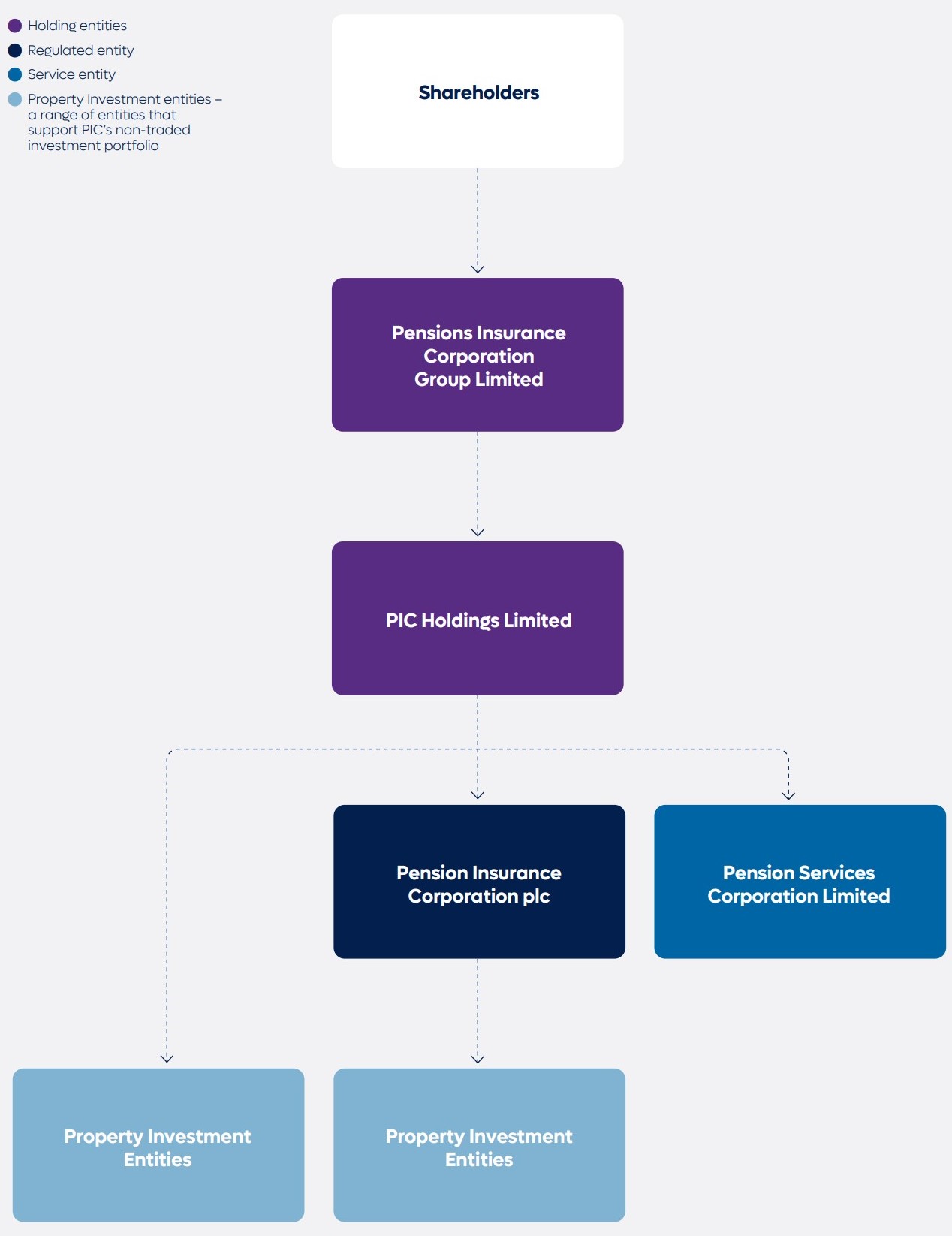

The group structure of PIC consists of two holding companies: our ultimate parent, Pension Insurance Corporation Group Limited, and PIC Holdings Limited. PIC is our regulated entity and represents around 98% of group assets. Pension Service Corporation Limited is our service company (see below group structure).

PIC’s group is located in London and does not have any overseas branches.

Our supply chains include facilities management, outsourced administrators, asset managers, reinsurers, other financial services providers, and developers and constructors on PIC’s build-to-rent projects.

We believe the risk of modern slavery (which encapsulates slavery, servitude and forced or compulsory labour, and human trafficking) in our business and our supply chain is low.

We recognise that PIC can also help tackle modern slavery through our role as an investor and lender.

We have a zero-tolerance approach to modern slavery and we are committed to ensuring that there is no slavery or human trafficking in our supply chains or in any part of our business. Our zero-tolerance approach is supported by our policies, which are embedded in our culture, are communicated on our internal intranet and are integral to all new employees’ inductions.

Our Recruitment Policy includes provisions to ensure that the recruitment process is fair, consistent and robust. The policy includes a requirement that only approved recruitment agencies may be used and all candidates must evidence their eligibility to work in the UK. This helps to safeguard against the risk of modern slavery in the recruitment process.

Our Whistleblowing Policy is designed to encourage employees to promptly report any suspected wrongdoing or dangers at work, including any suspicions of slavery or human trafficking. Workers can make such reports in the knowledge that their concerns will be taken seriously and investigated appropriately and confidentially.

Our Anti-Slavery and Human Trafficking Policy statement describes how we are committed to acting ethically and with integrity in all our business relationships, and how this is implemented and enforced through effective systems and controls to ensure slavery and human trafficking are not taking place anywhere in our business or our supply chains.

The Board has overall responsibility for our Anti-Slavery and Human Trafficking Policy. The General Counsel has primary day to day responsibility for implementing the policy, monitoring its use and effectiveness, dealing with any queries and auditing our internal controls to ensure they are effective in countering modern slavery. The policy was updated by the General Counsel in October 2023 and approved by the Executive Committee in October 2023. The policy is reviewed every two years. A report is provided to the Board annually.

Our employees are expected to report concerns, and management at all levels are responsible for ensuring those reporting to them understand and comply with the policy.

Due diligence, by way of Know Your Client ('KYC') checks and risk assessments, are carried out at the initial on-boarding stage for any new supplier. These checks and risk assessments are refreshed every two to five years depending on the type of supplier. We carry out detailed due diligence on our build-to-rent contractors and their supply chain and this due diligence includes questions on modern slavery.

In 2024, we finalised our first supplier Code of Conduct and are rolling this out across our suppliers. Our Code of Conduct sets out the standards and values we expect our suppliers to follow, including in relation to Environmental, Social and Governance ('ESG') topics and modern slavery.

We also introduced a new ESG questionnaire to our supplier due diligence process, which includes detailed questions in relation to modern slavery, including:

We use LSEG World-Check reports as part of our KYC process to perform due diligence on all new suppliers at both company and director level, including for the purposes of detecting any modern slavery and illegal trafficking, as well as money laundering, financial crime, serious misconduct, unethical conduct and other criminal or unlawful activity.

Our due diligence processes allow us to identify, assess, monitor and therefore minimise potential risks of modern slavery in our supply chains. Our KYC and risk assessment processes are constantly under review to improve supplier vetting and to further minimise risks, including the risk of slavery and human trafficking.

We further mitigate the risk of slavery and human trafficking occurring in our supply chains by seeking to ensure that our point of contact is preferably with a UK company or branch. We expect all of our suppliers and contractors to contractually agree to comply with modern slavery legislation, to have suitable policies and processes, and to comply with our Code of Conduct.

Given the purpose of PIC is to pay the pensions of our current and future policyholders, it is our responsibility to protect our investment portfolio from the impact of all types of risks. Environmental Social and Governance ('ESG') risks and opportunities have always been an inherent part of PIC’s approach to assessing the suitability of long-term investments.

PIC is a signatory to the UN Principles of Responsible Investment ('UNPRI') and has been since early 2020. PIC takes pride in the genuine actioning of the principles and this has been recognised through our 4 Star, and well above average, assessment in the latest 2023 UNPRI assessment process. The UNPRI’s transparency report is submitted every other year and we will be assessed again in 2025.

PIC has maintained its signatory status to the UK Stewardship Code for a second consecutive year, which is a testament to the emphasis we put on our engagement activity. Our two-year engagement strategy has come to an end and some of our lessons learned in relation to social risks, including modern slavery, are:

Building on the success of our two-year engagement strategy, we recently launched a Board approved five-year engagement strategy, which runs from 2025-2030. The new strategy is split between asset classes and will formally expand our focus across six core topics, two of which in particular are relevant social topics:

In addition, we have updated our real-asset ESG Scorecards, which now include a social value matrix to measure social value created through the development process. We have also worked with a third party to develop a social value index, which is a tool to compare local authorities in England to assess their potential social value creation across five categories: education & skills, affordable housing, build-to-rent, infrastructure and renewable energy. This tool should enable us to focus our investment activity to enhance social value creation.

Some notable actions for our Responsible Investing team over 2024 with regards to modern slavery are:

We have training on modern slavery available to all our employees. This is designed to raise awareness of what modern slavery is, who is affected, how to spot the signs of modern slavery, and what to do if you spot the signs of modern slavery. This training is compulsory for those employees in our facilities team and investment team, who are most likely to come across potential risk areas. The completion of the training modules is monitored weekly and as at 31 December 2024, there was 100% compliance. New starters have 30 days to complete their compliance modules from their start date.

We expect all employees to provide an attestation to our Anti-Slavery and Human Trafficking Policy, and this policy is flagged to new employees in the induction process.

All workers are required annually to complete training on whistleblowing, to ensure they are aware of the appropriate reporting mechanisms if they do have any suspicions of any wrongdoing, including modern slavery.

All workers are regularly required to complete training on anti-money-laundering (noting that the proceeds of crime could include the proceeds of modern slavery) and counter terrorist financing, to ensure all employees can identify the signs of suspicious activity and understand our due diligence and suspicious activity reporting processes.

In 2024, we asked one of our Asset Manager partners to host a firm-wide session on modern slavery for us. The session focused on identifying modern slavery within the supply chain, including that of our investee companies. Over 40 PIC employees from across the investment, third party management and legal teams attended.

Topics discussed were:

The Key Performance Indicators ('KPIs') below help summarise the effectiveness of the steps we have taken in 2024 to ensure slavery and human trafficking are not taking place in our business or supply chains:

This statement was approved by the Board of Pension Insurance Corporation plc.

David Weymouth

Chairman of Pension Insurance Corporation plc

Date: 27 March 2025